How Hybrid Cars Function to Deliver Needed Power When Reducing Fuel Consumption

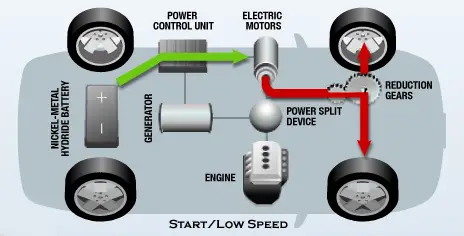

The term hybrid indicates duality in nature, and that is exactly what hybrid cars entail. Beneath the hood are two powerhouses, that maybe the electric motor plus the gasoline engine as opposed to the conventional single point of energy identified in non-hybrid cars, which was the gasoline or diesel-powered engine.

The Electric Battery

The electric motor handles normal stop-and-go travel and initial highway acceleration. The electric motor also assists the gas or diesel engine to minimize fuel consumption and emissions. As an example, it is the electric motor that drives energy-wasting accessories like the power steering pump and air conditioner,

The Gasoline Motor

At higher speeds like steady highway cruising, computers automatically switch on the gas-burning engine, which then requires more than from the electric battery as the major driving force of your car. Commonly, the compact engine is developed with variable valve timing with intelligence (VVT-i) and other advances …

How Hybrid Cars Function to Deliver Needed Power When Reducing Fuel Consumption Read More

Hybrid Electric Vehicle Education Educator (HEVTE) is a heavily modified third generation Toyota Prius. Sales Tax Exclusion for Manufacturers: California’s Alternative Power and Advanced Transportation Financing Authority (CAEATFA) supplies a sales tax exclusion for advanced companies and producers of option source and advanced transportation merchandise, elements or systems. Alternative Fuel & Sophisticated Vehicle Technology Tax Credit: An income tax credit of up to $6,000 is obtainable for a motor vehicle that makes use of or is converted to use an option fuel, is a hybrid electric vehicle or has its energy supply replaced with one that uses an option fuel.

Hybrid Electric Vehicle Education Educator (HEVTE) is a heavily modified third generation Toyota Prius. Sales Tax Exclusion for Manufacturers: California’s Alternative Power and Advanced Transportation Financing Authority (CAEATFA) supplies a sales tax exclusion for advanced companies and producers of option source and advanced transportation merchandise, elements or systems. Alternative Fuel & Sophisticated Vehicle Technology Tax Credit: An income tax credit of up to $6,000 is obtainable for a motor vehicle that makes use of or is converted to use an option fuel, is a hybrid electric vehicle or has its energy supply replaced with one that uses an option fuel. Also in the mix is a DC-DC converter to drop the 60 volts down to 12 volts for the handful of accessories that are in the plans. Plug-In Electric Car Rebates: The Massachusetts Division of Power Resources has a plan named Massachusetts Presents Rebates for Electric Vehicles (MOR-EV), which offers rebates of up to $2,500 to shoppers buying PEVs. Plug-in Hybrid Electric Automobiles (PHEVs) are powered by conventional or option fuels as effectively as electric power stored in a battery. Electric Automobiles (EVs) are propelled by a battery-powered motor, and the battery is charged by plugging the car into the electric grid either at residence or at a public charging station.

Also in the mix is a DC-DC converter to drop the 60 volts down to 12 volts for the handful of accessories that are in the plans. Plug-In Electric Car Rebates: The Massachusetts Division of Power Resources has a plan named Massachusetts Presents Rebates for Electric Vehicles (MOR-EV), which offers rebates of up to $2,500 to shoppers buying PEVs. Plug-in Hybrid Electric Automobiles (PHEVs) are powered by conventional or option fuels as effectively as electric power stored in a battery. Electric Automobiles (EVs) are propelled by a battery-powered motor, and the battery is charged by plugging the car into the electric grid either at residence or at a public charging station. Animation of a car with a battery, electric motor, and internal combustion engine inside and an icon depicting traditional or option fuel outdoors. HOV Lane Exemption: Certified option fuel vehicles—including hydrogen, hybrid, and electric vehicles—may use designated HOV lanes regardless of the quantity of occupants in the automobile. Electric Automobile Supply Gear Rebate: Indiana Michigan Energy provides rebates of up to $2,500 to residential consumers who obtain or lease a new plug-in electric automobile and set up a Level 2 EVSE with a separate meter.

Animation of a car with a battery, electric motor, and internal combustion engine inside and an icon depicting traditional or option fuel outdoors. HOV Lane Exemption: Certified option fuel vehicles—including hydrogen, hybrid, and electric vehicles—may use designated HOV lanes regardless of the quantity of occupants in the automobile. Electric Automobile Supply Gear Rebate: Indiana Michigan Energy provides rebates of up to $2,500 to residential consumers who obtain or lease a new plug-in electric automobile and set up a Level 2 EVSE with a separate meter. The U.S. transportation technique primarily relies on oil to transport men and women and goods from a single place to another. Option Fuel Vehicle Rebate Program: The Clean Car Rebate Project (CVRP) gives rebates for the buy or lease of certified cars. Parking Charge Exemption: Certified automobiles with electric vehicle license plates are exempt from certain parking fees charged by any non-federal government authority. The battery is charged by way of regenerative braking and the internal combustion engine. Moreover, the operating charges of an electric vehicle can be a lot decrease due to the low cost of electricity relative to traditional fuel, although PEVs usually expense additional than standard vehicles. The credit may not exceed the lesser of $400 or the state income tax imposed for that tax year.

The U.S. transportation technique primarily relies on oil to transport men and women and goods from a single place to another. Option Fuel Vehicle Rebate Program: The Clean Car Rebate Project (CVRP) gives rebates for the buy or lease of certified cars. Parking Charge Exemption: Certified automobiles with electric vehicle license plates are exempt from certain parking fees charged by any non-federal government authority. The battery is charged by way of regenerative braking and the internal combustion engine. Moreover, the operating charges of an electric vehicle can be a lot decrease due to the low cost of electricity relative to traditional fuel, although PEVs usually expense additional than standard vehicles. The credit may not exceed the lesser of $400 or the state income tax imposed for that tax year.